is there real estate transfer tax in florida

Another tax that Canadians should consider when purchasing real property in Florida is the estate tax. Miami-Dades tax rate is 60 cents.

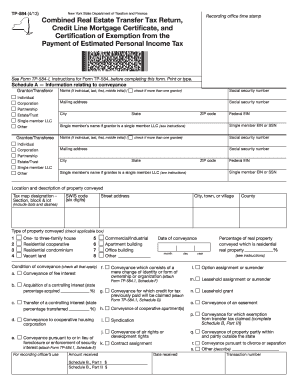

Real Estate Transfer Tax Ny State Propertyshark Com

This tax is normally paid at closing to the Clerk of.

. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home. Florida real property tax rates are implemented in millage rates which is 110 of a percent. If passed this new transfer tax would be 20 for amounts over 2.

Since there is no other consideration for the transfer. The first is the property tax. Counties in Florida collect an average of 097 of a propertys assesed fair.

An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. There is no Florida estate tax though you may still be subject to the federal estate tax. The Florida documentary stamp tax is a real estate transfer tax.

In some areas real estate transfer tax is considered a fee for processing the transfer paperwork even though you dont need to pay 1000 or 2000 to. The Florida documentary stamp tax is applied at a rate of 070 per 100 paid for the property in every. In Florida transfer tax is called a documentary stamp tax.

The documentary stamp tax on a 150000 home would equal. Further for all other types of transfers in Miami-Dade County there. Is there real estate transfer tax in florida Wednesday February 16 2022 Edit.

In all counties except Miami-Dade County the Florida documentary stamp tax rate is 070 per 100 paid for the property. In Miami-Dade County however the stamp tax rate is 60 per 100 or a rate of 06 for transfers of single-family residences. The transfer tax in Florida is levied at 70 cents for each 100 of consideration for most recorded documents including deeds of conveyance.

Florida Properties Tax Benefits Florida Real Estate Florida Broward With The Passage Of The. Estate taxes impose a tax liability on the estates of Canadians. The state of Florida commonly refers to transfer tax as documentary stamp tax.

Does Florida have real estate transfer tax. The Massachusetts real estate transfer excise tax is currently 258 per 500 value transferred which is a 0456 tax rate. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

There is no specific exemption for documents that transfer Florida real property for estate planning. Documents that transfer an interest in Florida real property such as deeds. Florida does not have an inheritance tax so Floridas inheritance tax rate is.

Typically the real estate agent obtains a check for the amount from the seller. For the purposes of determining. Its customary for the seller of the property to pay for this tax in Florida.

There is currently no Boston. Massachusetts MA Transfer Tax. The District of Columbia reduces its deed recordation tax for first-time homebuyers to 0725 for values up to 400000.

South Carolina Real Estate Transfer Taxes An In Depth Guide

Tangible Personal Property State Tangible Personal Property Taxes

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Transfer Tax And Documentary Stamp Tax Florida

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/URGPECSXRNDTNFO3IH6EIDFN64.jpg)

Philly Misses Full Bounty Of Shops At Schmidts Sale As Transfer Tax Shortfalls Persist

Transfer Tax Calculator 2022 For All 50 States

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Should I Transfer The Title On My Rental Property To An Llc

Florida Quitclaim Deed Form Legal Templates

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

How Much Does It Cost To Sell A House Zillow

How To Remove A Deceased Owner From A Title Deed To Real Estate

Fillable Online Realpropertyabstract Printable Combined Real Estate Transfer Tax Return Tp584 Form Realpropertyabstract Fax Email Print Pdffiller

Real Estate Transfer Tax What Are They Where Does The Money Go

Florida Real Estate Exam Sample Question 2022 Documentary Stamps And Intangible Tax Youtube